AARP says the average family spends more than $7,000 a year caring for an aging parent — about 26% of their income — creating financial hardship for many.

When Scott Thomas realized his parents needed to move to assisted living, he wasn’t prepared for the cost.

"I wanted to do everything I can to help them continue to have the best life possible, but it's a lot more money than you think even if you've saved for it," Thomas said.

IN RELATED NEWS | Age in America: Is there a 'magic number' Americans need to retire comfortably?

Matt Schulz, chief consumer finance analyst at LendingTree, says Thomas’ experience is common.

"About 60% of people who support their parents say that they've taken on debt, and for a lot of people the numbers aren't that huge, but about 13% say they've taken on $25,000 or more in debt over this situation," Schulz said.

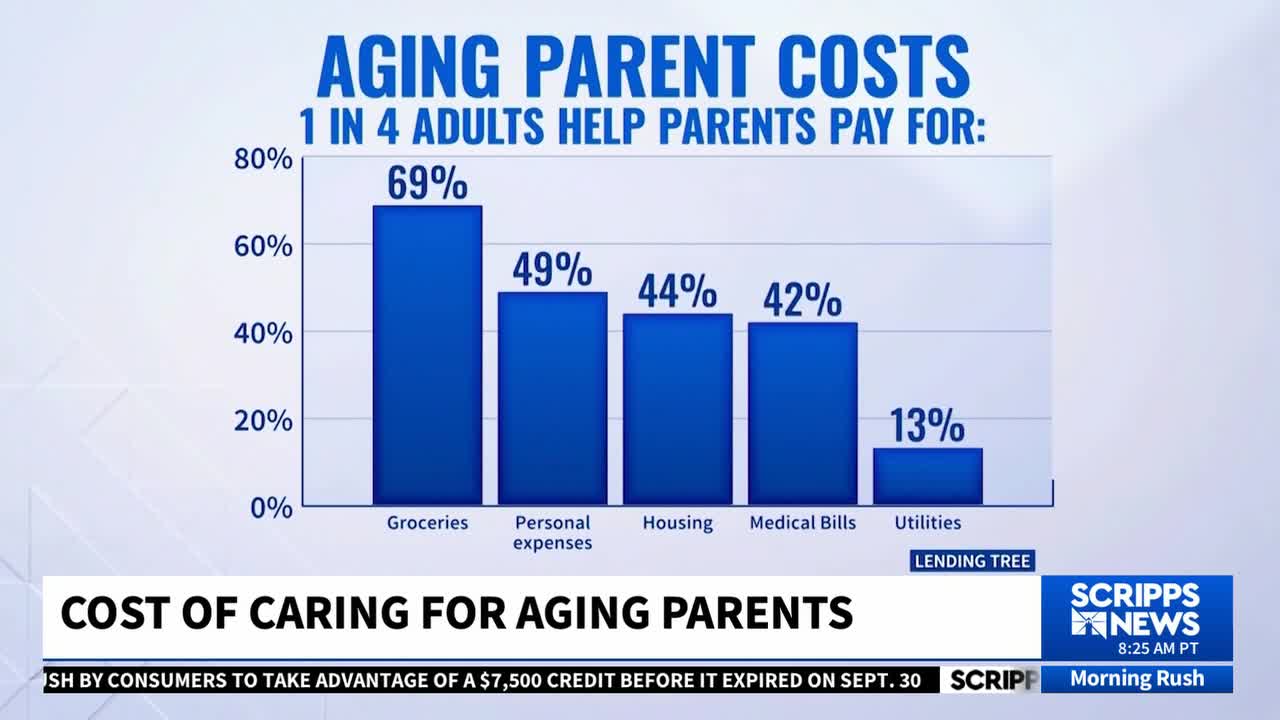

A recent LendingTree survey found that nearly one-in-four adults are already helping their parents financially — covering groceries, personal expenses, housing, medical bills and utilities. Just as many say they expect to provide support in the future.

Brian Sullivan with Assisted Living Locators helps families find senior living options for aging parents that fit their budgets.

"There are four primary types of care: independent living, assisted living, memory care and skilled nursing — which we all know as nursing homes," Sullivan said. "And as you go through that continuum the costs go up."

Experts warn of a generational domino effect as Americans live longer.

"It is going to make it harder, going backwards for generations to get ahead when it comes to their own retirement. And to be able to have enough money to put towards long-term financial goals," Schulz said.

IN CASE YOU MISSED IT | Trump’s new 401(k) policy may increase returns, but also raise risks

Sullivan advises families to prepare early.

"Talking to financial advisors, estate planning attorneys, folks like myself, living advisors — understanding some of the dynamics at play," he said.

It’s something Thomas now considers.

"I'm thinking about what about us, you know, when we get older, do we have enough savings for ourselves so that we don't put other family members in the situation as well," he said.

Gen Xers believe they’ll need more than $1.5 million to retire comfortably, but more than half say they don’t think they will reach that goal.

This story was initially reported by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.